Think of this scenario, if you want so much to do something, say dance, be a model, an actress, or be a great chef, what is the your purpose of doing so? Maybe because you really want it, that is your passion. Or maybe you want to make money out of something that you love doing or really interested in. Like in college.

After realizing what your purpose, what do you do?

- research about it (talk to people, online reading)

- read more about it, watch media about it ( t.v. shows, dvd’s)

- if you really want to jump in, you enroll in classes (private investment in education)

Listed above are just some steps that you may take if you are really interested in something or want to succeed in doing something. The main point? Education in anything is a private investment is important that you take because it pays you in whatever form ( satisfaction, money, fulfillment)…forever.

You wouldn’t care much about the cost of learning it, because it is something you really want to do, make you understand more and whatever you gain is yours for the rest of your life.

What does that have to do with Forex? Well, it has everything to do with it. If you really want it, the same steps above (research, read, study and enroll in classes in) is the most common thing to do. Not only can it pay you hundred fold over and over again, but whatever you learn is yours forever!

The importance of such education in Forex is that you deal with real money here, mistakes can never be more devastating, but the other side of it, if done with the best forex trading method, as in a forex course would show you, rewards are just so overwhelming! Smart and elite traders invests in education, because they are constantly evolving. As our education grows, so is our portfolios, so is our home, our car, our lifestyle.

Free Courses and Paid Courses

Free Courses are great in Forex, a Forex mentor give that to share knowledge and experiences. On the other hand, paid courses are like courses in college, you pay for it, it has a systematic approach and specific curriculum, is based on research and study, and triggers your mind to grow in such a progressive way that the only destination for you is success.

There are many sources out ther just to get the money, after you pay, they disappear. A credible resource should be your choice, because in Forex, education is something you must not take for granted.

Online courses are still the choice for forex, not only can you have access to the best courses anywhere you are, but course materials online give you flexibility. If you are working, you can have access to your materials online in your part time. A mom can study forex when the kids are at school or asleep. That flexibility is what makes the internet a great invention.

A suggestion….

To save you time in finding the “right one” in Forex courses (with all the scams that promises ‘instant profits’), one of the most credible sources out there is Bill Poulos. He has received so many thumbs up with the courses he had made and has produced many successful Forex Traders out there.

With his latest Forex Course, The Forex Profit Accelerator, it is designed to make you learn how to profitably trade 20-30 minutes trading by the end of day ( 5:00 pm New York Close), so great for part time traders that doesn’t want to stare at charts all day.

What makes him special?

In all his courses, he practices transparency, honesty, simplicity and effectiveness that his courses are made from research and survey among Forex Traders themselves, the situations they deal themselves. A systematic yet easy to understand teaching style, and honesty that he answers all questions by his participants as fast as possible.

Quality information materials is what the core of the Forex Profit Accelerator, you get so many bonuses, free e-books and forex trading tutorials other than what you have paid for. And the customer support is superb. Think of you favorite teacher that answers to you all your questions no matter how many are they; he just wants you to understand as much as possible. Knowledge always starts with a question indeed.

If you want to achieve financial success, it always relies on you, but a forex course, like the Forex Profit Accelerator can give you confidence and a scientific way of learning that minimizes your risk and makes you get lots of pips as possible.

Bill Poulos transparency, honesty and strong emphasis on the essential elements every trader should learned has sealed the deal with Forex Profit Accelerator. Aren’t you tired with the overnight claims of BIG profits? It is so refreshing to hear Bill say that he has also losing trades. Nobody wins 100% indeed. Hearing from him how to manage trades, because you will lose some to gain more, made thousands of believers in Traders.

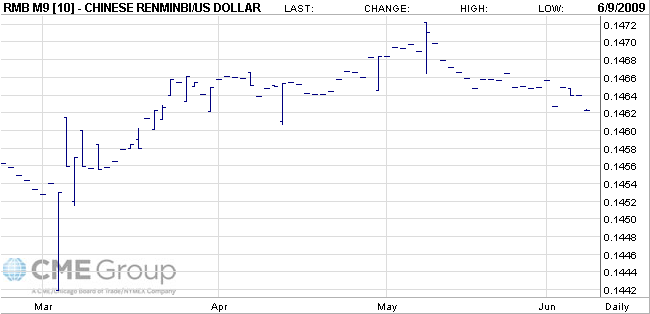

The “uncertainty” narrative will likely continue to drive the markets for the near-term, as neither the optimists nor the pessimists have the data to support their respective positions. In all likelihood, the markets will trend sideways and safe haven currencies will see a slight inflow, until there is confirmation that the economy is firmly on the path to recovery.

The “uncertainty” narrative will likely continue to drive the markets for the near-term, as neither the optimists nor the pessimists have the data to support their respective positions. In all likelihood, the markets will trend sideways and safe haven currencies will see a slight inflow, until there is confirmation that the economy is firmly on the path to recovery.